Your Property plant and equipment balance sheet images are ready in this website. Property plant and equipment balance sheet are a topic that is being searched for and liked by netizens today. You can Find and Download the Property plant and equipment balance sheet files here. Find and Download all free images.

If you’re looking for property plant and equipment balance sheet pictures information related to the property plant and equipment balance sheet interest, you have visit the right site. Our website always provides you with suggestions for downloading the highest quality video and image content, please kindly search and find more enlightening video content and graphics that fit your interests.

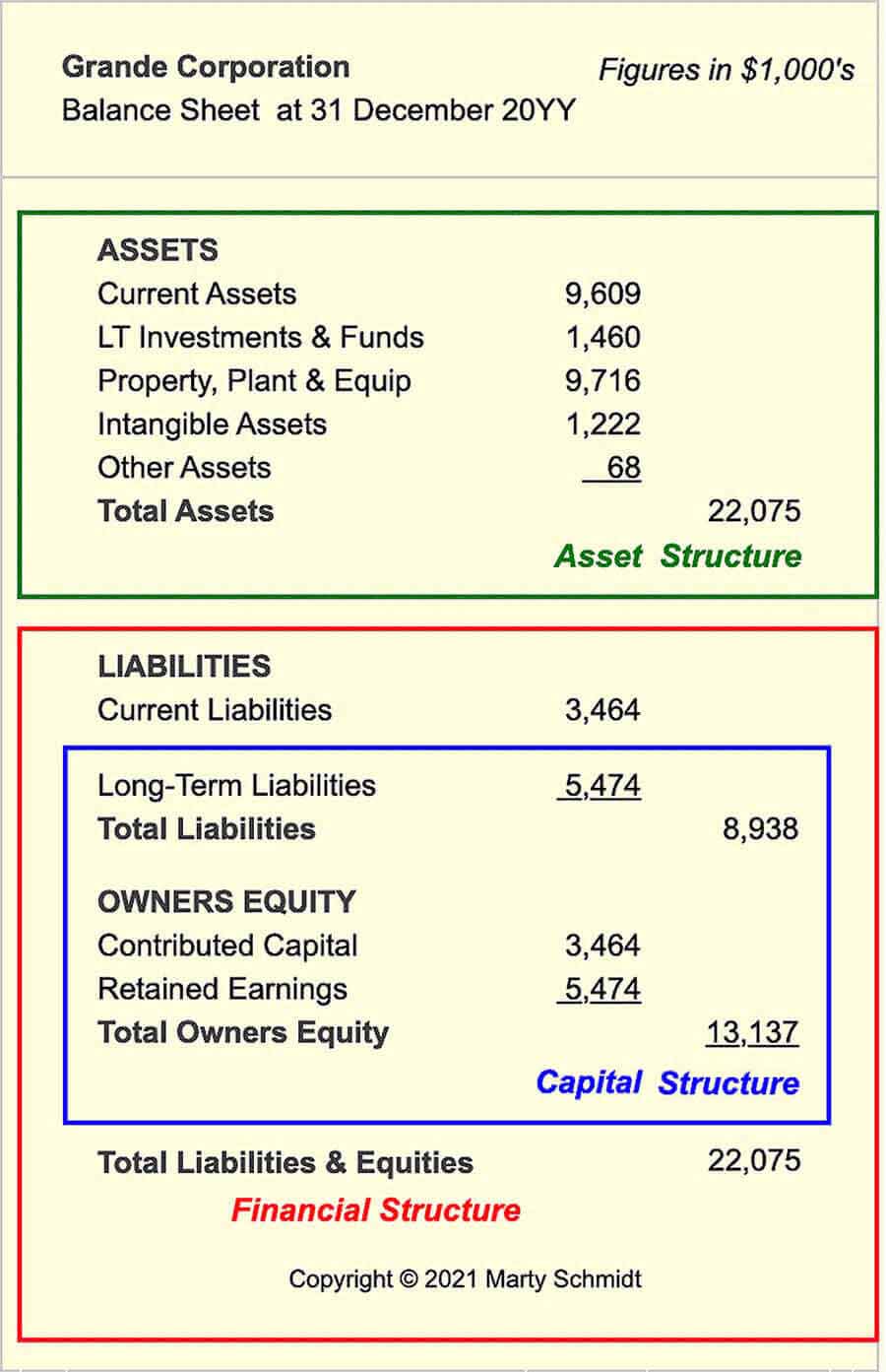

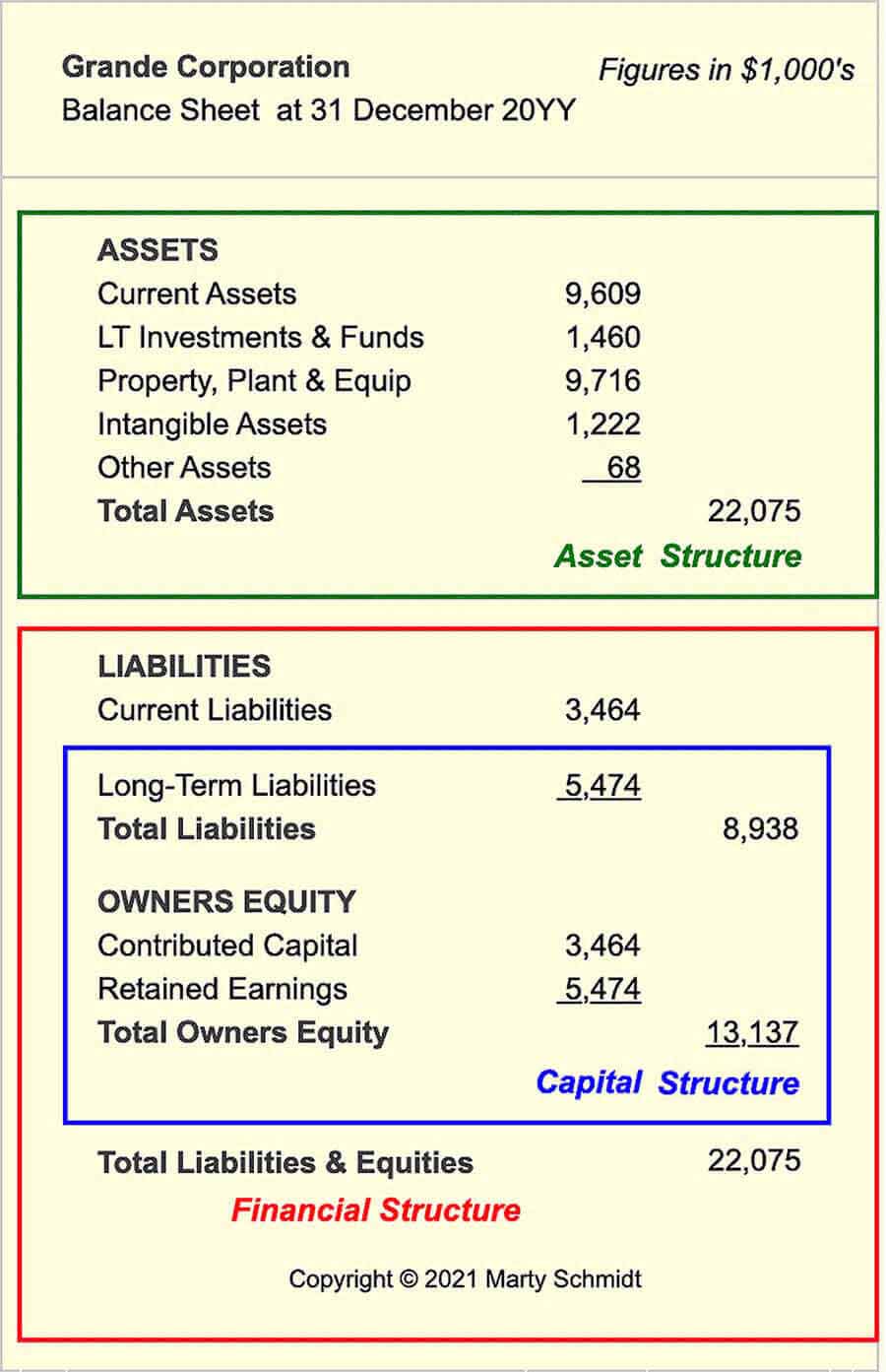

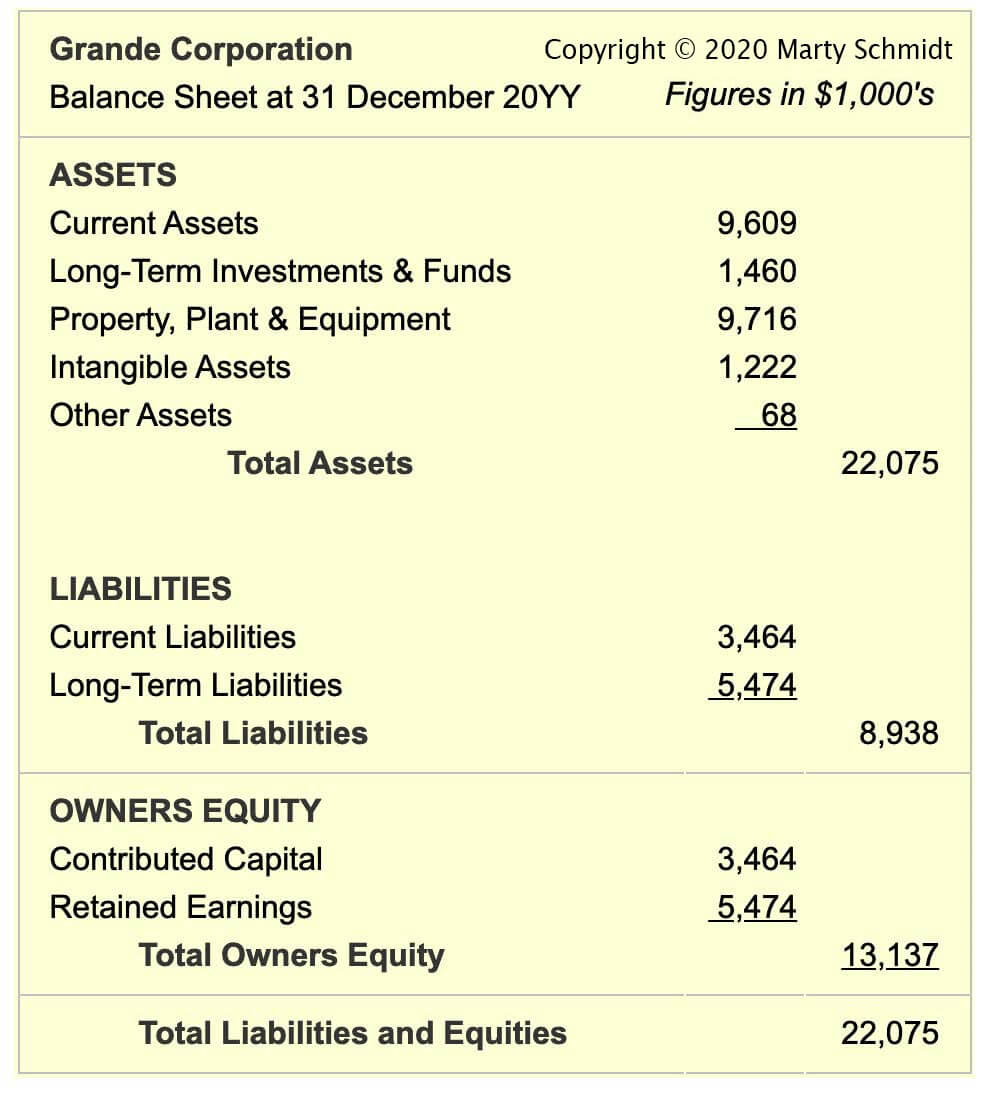

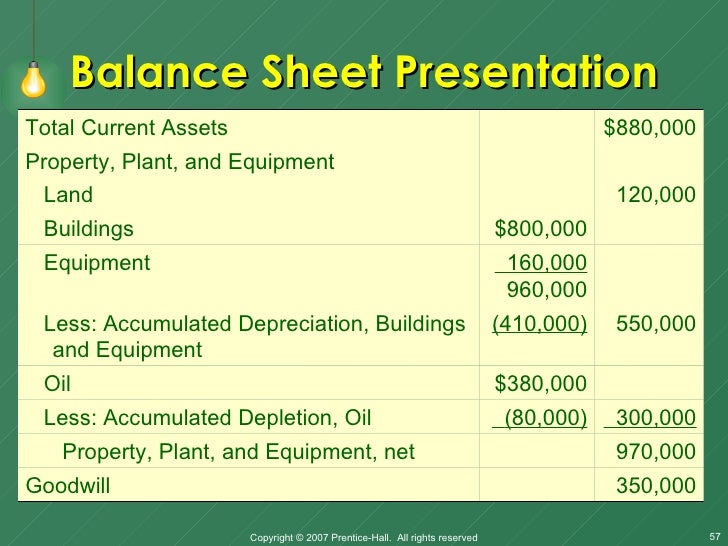

Property Plant And Equipment Balance Sheet. Courses / balance sheet / property, plant & equipment (pp&e) upgrade account. Property, plant equipment are material items on the balance sheet. Ppe is the largest asset, at $3,745 million ($3.745 billion) or 25 percent of total assets. The depreciation methods, useful lives and residual values are reviewed at each balance sheet date.

Property Plant And Equipment Section Of A Balance Sheet From profrty.blogspot.com

Property Plant And Equipment Section Of A Balance Sheet From profrty.blogspot.com

Property, plant, and equipment is reported on the balance sheet at: Your current access is limited. Ppe is the largest asset, at $3,745 million ($3.745 billion) or 25 percent of total assets. Property plant and equipment should not be valued higher than it’s the recoverable amount recoverable amount the recoverable amount of an asset is the present value of the expected cash flows that will result from the asset�s sale or use, and is determined as the greater of two amounts: There are inherent risks on ppe and auditors should be more concerned about these items during the audit. Ppe includes fixed assets that the entity uses for the production of goods and/or rendering of services.

D.historical cost minus residual value.

Courses / balance sheet / property, plant & equipment (pp&e) upgrade account. Analysts can use disclosures to better their understanding of a company’s investments in tangible and intangible assets. Hence to audit ppe, it is very important to perform proper audit procedures in order to obtain sufficient appropriate audit evidence for making a proper conclusion on ppe accounts. Ppe is the largest asset, at $3,745 million ($3.745 billion) or 25 percent of total assets. Next, subtract accumulated depreciation from the result. The depreciation methods, useful lives and residual values are reviewed at each balance sheet date.

Source: profrty.blogspot.com

Source: profrty.blogspot.com

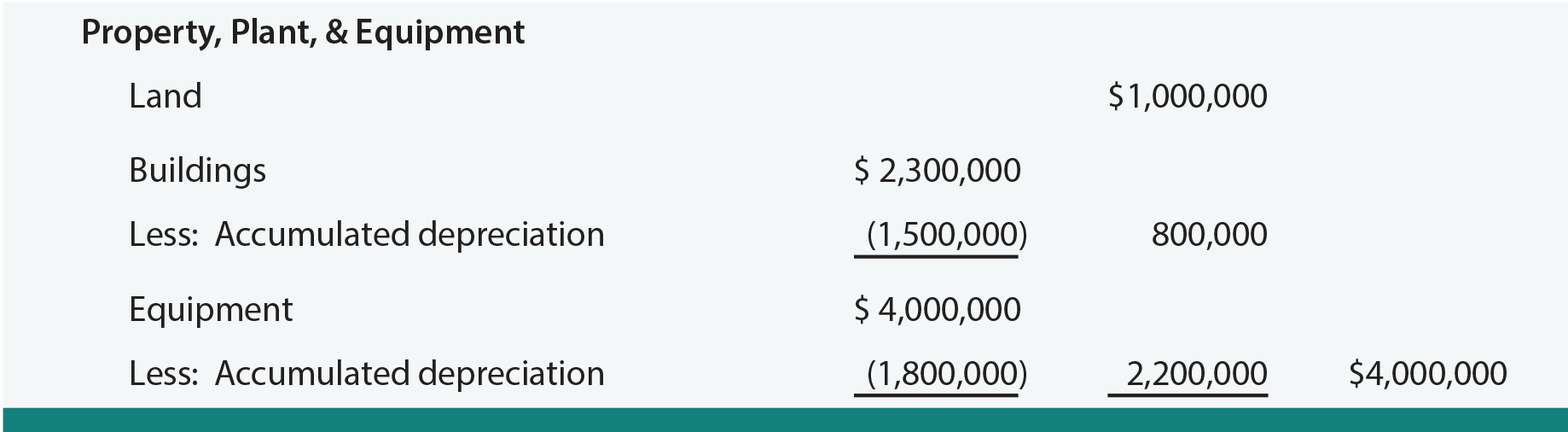

To calculate pp&e, add the amount of gross property, plant, and equipment, listed on the balance sheet, to capital expenditures. Other equipment, operating and office equipment : There are inherent risks on ppe and auditors should be more concerned about these items during the audit. Normally, property, plant, and equipment are mentioned as the first line item on the balance sheet. To calculate pp&e, add the amount of gross property, plant, and equipment, listed on the balance sheet, to capital expenditures.

Source: investopedia.com

Source: investopedia.com

The amount reported on the balance sheet for property, plant and equipment is the company�s estimate of the fair market value as of the balance sheet date. Property, plant, equipment, and intangible assets. Hence to audit ppe, it is very important to perform proper audit procedures in order to obtain sufficient appropriate audit evidence for making a proper conclusion on ppe accounts. The depreciation methods, useful lives and residual values are reviewed at each balance sheet date. To calculate pp&e, add the amount of gross property, plant, and equipment, listed on the balance sheet, to capital expenditures.

Source: profrty.blogspot.com

Source: profrty.blogspot.com

Property, plant & equipment (pp&e) property, plant & equipment (pp&e) is the value of the company�s properties, plants and equipment. To continue watching this lesson, you�ll need to purchase a subscription. Other equipment, operating and office equipment : Accounting for property, plant and equipment (ppe) ppe consists of tangible assets used primarily to manufacture inventory. To calculate pp&e, add the amount of gross property, plant, and equipment, listed on the balance sheet, to capital expenditures.

Source: pinterest.com

Source: pinterest.com

Accounting rules also require that the plant assets be reviewed for possible impairment losses. Next, subtract accumulated depreciation from the result. Other equipment, operating and office equipment : Property, plant, and equipment is reported on the balance sheet at: These assets are commonly referred to as the company�s fixed assets or plant assets.

Source: sec.gov

Source: sec.gov

The depreciation methods, useful lives and residual values are reviewed at each balance sheet date. The depreciation methods, useful lives and residual values are reviewed at each balance sheet date. A video tutorial by perfectstockalert.com designed to teach investors and traders everything they need to know about property plant and equipment on the bala. There are inherent risks on ppe and auditors should be more concerned about these items during the audit. Your current access is limited.

Source: accountingintheheadlines.com

Source: accountingintheheadlines.com

Other equipment, operating and office equipment : Ppe includes fixed assets that the entity uses for the production of goods and/or rendering of services. To calculate pp&e, add the amount of gross property, plant, and equipment, listed on the balance sheet, to capital expenditures. Analysts can use disclosures to better their understanding of a company’s investments in tangible and intangible assets. Payments on account and assets under construction :

Source: coursehero.com

To calculate pp&e, add the amount of gross property, plant, and equipment, listed on the balance sheet, to capital expenditures. Analysts can use disclosures to better their understanding of a company’s investments in tangible and intangible assets. In the audit of ppe, the inherent risk of ppe involves more on the existence and valuation of their balances. Hence to audit ppe, it is very important to perform proper audit procedures in order to obtain sufficient appropriate audit evidence for making a proper conclusion on ppe accounts. Changes in property, plant and equipment in the period january 1 to december 31, 2020 € million :

Source: profrty.blogspot.com

Courses / balance sheet / property, plant & equipment (pp&e) upgrade account. Property, plant & equipment (pp&e) property, plant & equipment (pp&e) is the value of the company�s properties, plants and equipment. The result is the overall value of the pp&e. The depreciation methods, useful lives and residual values are reviewed at each balance sheet date. Therefore, from an investor’s perspective, it is an important indicator of.

Source: staeti.blogspot.com

Changes in property, plant and equipment in the period january 1 to december 31, 2020 € million : The depreciation methods, useful lives and residual values are reviewed at each balance sheet date. Property, plant, and equipment is reported on the balance sheet at: In addition, disclosures reveal how the changes. The depreciation methods, useful lives and residual values are reviewed at each balance sheet date.

Source: profrty.blogspot.com

Source: profrty.blogspot.com

Normally, property, plant, and equipment are mentioned as the first line item on the balance sheet. Property, plant, equipment, and intangible assets. Next, subtract accumulated depreciation from the result. Technical equipment and machinery : A video tutorial by perfectstockalert.com designed to teach investors and traders everything they need to know about property plant and equipment on the bala.

Source: principlesofaccounting.com

Source: principlesofaccounting.com

The asset�s fair value as reduced by related selling costs, and the asset�s value in use. Other equipment, operating and office equipment : The amount reported on the balance sheet for property, plant and equipment is the company�s estimate of the fair market value as of the balance sheet date. Property, plant, & equipment is a separate category on a classified balance sheet. Technical equipment and machinery :

Source: slideshare.net

Source: slideshare.net

D.historical cost minus residual value. Other equipment, operating and office equipment : There are inherent risks on ppe and auditors should be more concerned about these items during the audit. Your current access is limited. Payments on account and assets under construction :

Source: accountingcoach.com

Source: accountingcoach.com

Accounting rules also require that the plant assets be reviewed for possible impairment losses. Therefore, from an investor’s perspective, it is an important indicator of. How is property plant and equipment valued on the balance sheet? How is property, plant, and equipment measured? Other equipment, operating and office equipment :

Source: chegg.com

Source: chegg.com

The amount reported on the balance sheet for property, plant and equipment is the company�s estimate of the fair market value as of the balance sheet date. A video tutorial by perfectstockalert.com designed to teach investors and traders everything they need to know about property plant and equipment on the bala. To calculate pp&e, add the amount of gross property, plant, and equipment, listed on the balance sheet, to capital expenditures. In the audit of ppe, the inherent risk of ppe involves more on the existence and valuation of their balances. Therefore, from an investor’s perspective, it is an important indicator of.

Source: chegg.com

Source: chegg.com

The estimated useful lives and depreciation methods of property, plant and equipment are based on historical values, plans and estimates. Equipment is classified in the balance sheet as a) a current asset. The amount reported on the balance sheet for property, plant and equipment is the company�s estimate of the fair market value as of the balance sheet date. Property, plant & equipment (pp&e) property, plant & equipment (pp&e) is the value of the company�s properties, plants and equipment. How is property plant and equipment valued on the balance sheet?

Source: coursehero.com

B) property, plant, and equipment. Changes in property, plant and equipment in the period january 1 to december 31, 2020 € million : These assets are commonly referred to as the company�s fixed assets or plant assets. There are inherent risks on ppe and auditors should be more concerned about these items during the audit. Hence to audit ppe, it is very important to perform proper audit procedures in order to obtain sufficient appropriate audit evidence for making a proper conclusion on ppe accounts.

Source: baylor.edu

Source: baylor.edu

Generally, the property, plant and equipment assets are reported at their. Property, plant, & equipment is a separate category on a classified balance sheet. Next, subtract accumulated depreciation from the result. B) property, plant, and equipment. Changes in property, plant and equipment in the period january 1 to december 31, 2018 € million :

Source: accountancyknowledge.com

Source: accountancyknowledge.com

To calculate pp&e, add the amount of gross property, plant, and equipment, listed on the balance sheet, to capital expenditures. Property, plant, and equipment is reported on the balance sheet at: Technical equipment and machinery : Accounting for property, plant and equipment (ppe) ppe consists of tangible assets used primarily to manufacture inventory. Property, plant, & equipment is a separate category on a classified balance sheet.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title property plant and equipment balance sheet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.