Your Property plant and equipment examples images are available in this site. Property plant and equipment examples are a topic that is being searched for and liked by netizens today. You can Get the Property plant and equipment examples files here. Find and Download all royalty-free images.

If you’re searching for property plant and equipment examples images information linked to the property plant and equipment examples keyword, you have pay a visit to the ideal site. Our website frequently provides you with suggestions for downloading the maximum quality video and image content, please kindly surf and find more informative video content and images that match your interests.

Property Plant And Equipment Examples. When compared to exxon�s total assets of over $354 billion for the. A) are held for use to produce/supply goods and services, for rental to others, or for administrative purposes; Therefore, the initial purchase price of the asset should be: For example, a company�s land, as well as any structures erected on it, furniture, machinery, and equipment.

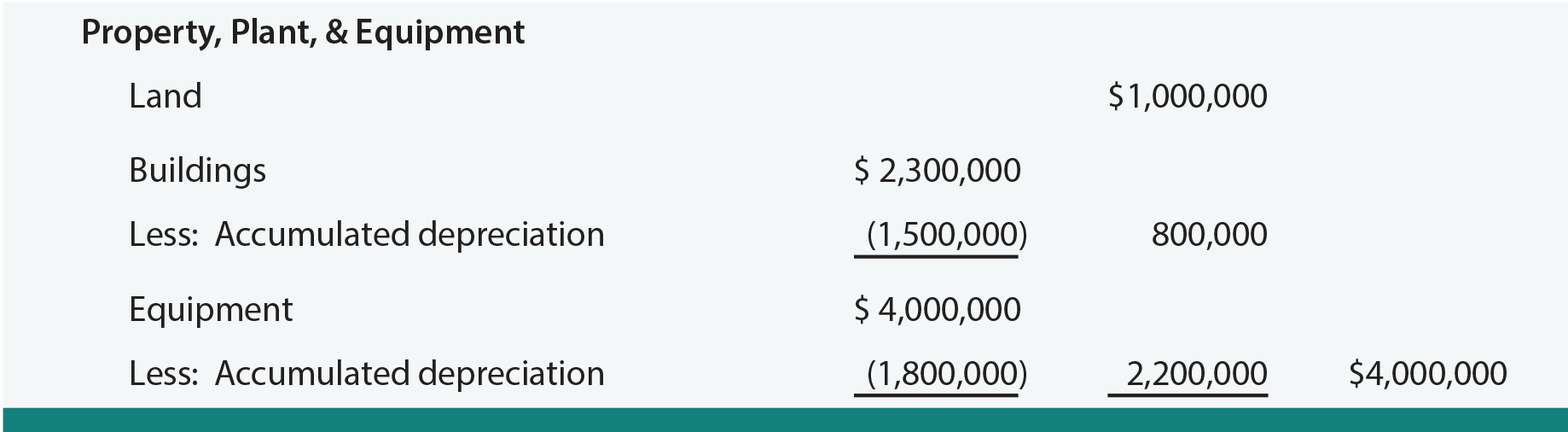

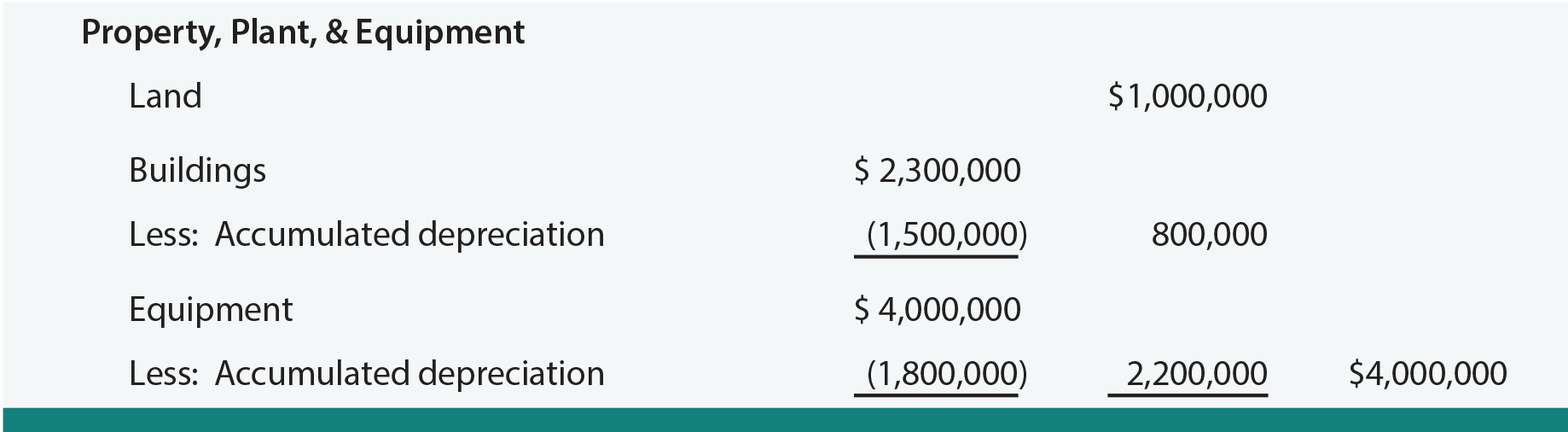

What Costs Are Included In Property, Plant, & Equipment From principlesofaccounting.com

What Costs Are Included In Property, Plant, & Equipment From principlesofaccounting.com

Examples of directly attributable costs include: Peace corps | ms 711 accounting for property, plant, and equipment page 4 (o) leasehold improvements refers to any construction costs (e.g., alter, renovate, add, or remodel) incurred for a leased property (e.g., building an extension to an existing or new office or making an improvement for added security to an existing residence). Note that directly attributable costs do not need to be incremental. The principal issues in accounting for property, plant and equipment are the recognition of the assets, Standard ias 16 prescribes the accounting treatment for property, plant and equipment and therefore it is one of the most important and commonly applied standards. A) are held for use to produce/supply goods and services, for rental to others, or for administrative purposes;

In the above example, ella may want to purchase enough land to allow for a building and a small dog park area.

Freight for delivery of the plant components to the installation site amounted to $0.2 million. Key assertions for the audit of property, plant, and equipment are described below: Other standards have made minor consequential amendments to ias 16. Paragraph ias 16.17 provides examples of directly attributable costs that can be included in the cost of pp&e. Determine the depreciable amount of the item as it would be initiated before the changes. Items grouped within a class are typically depreciated using a common depreciation calculation.

Source: investopedia.com

Source: investopedia.com

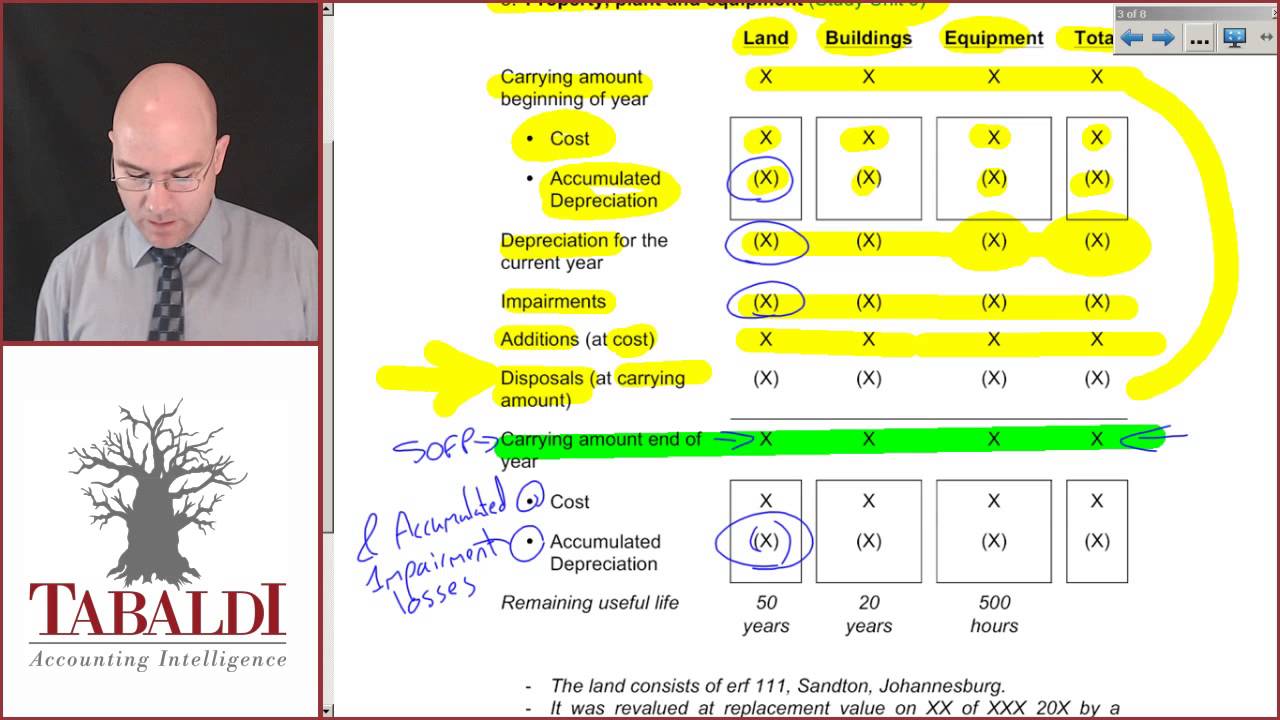

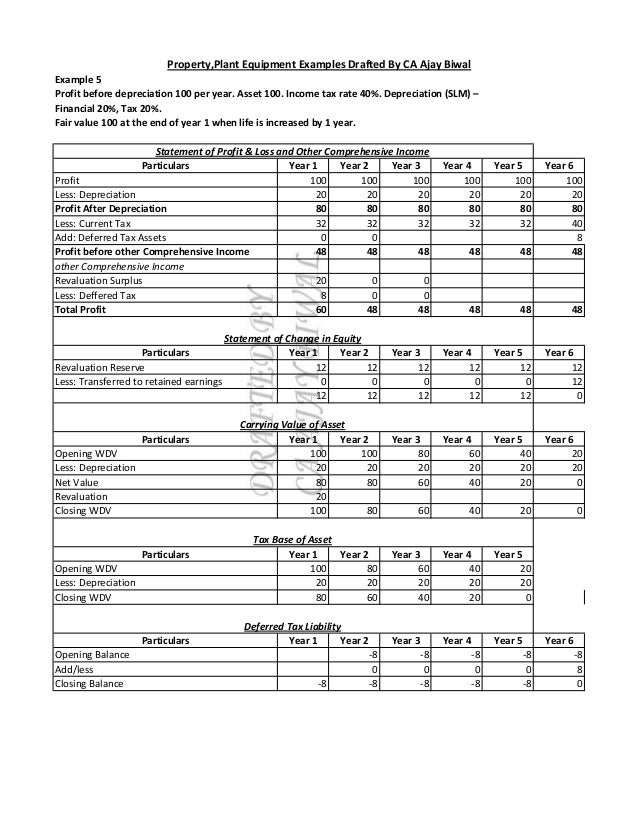

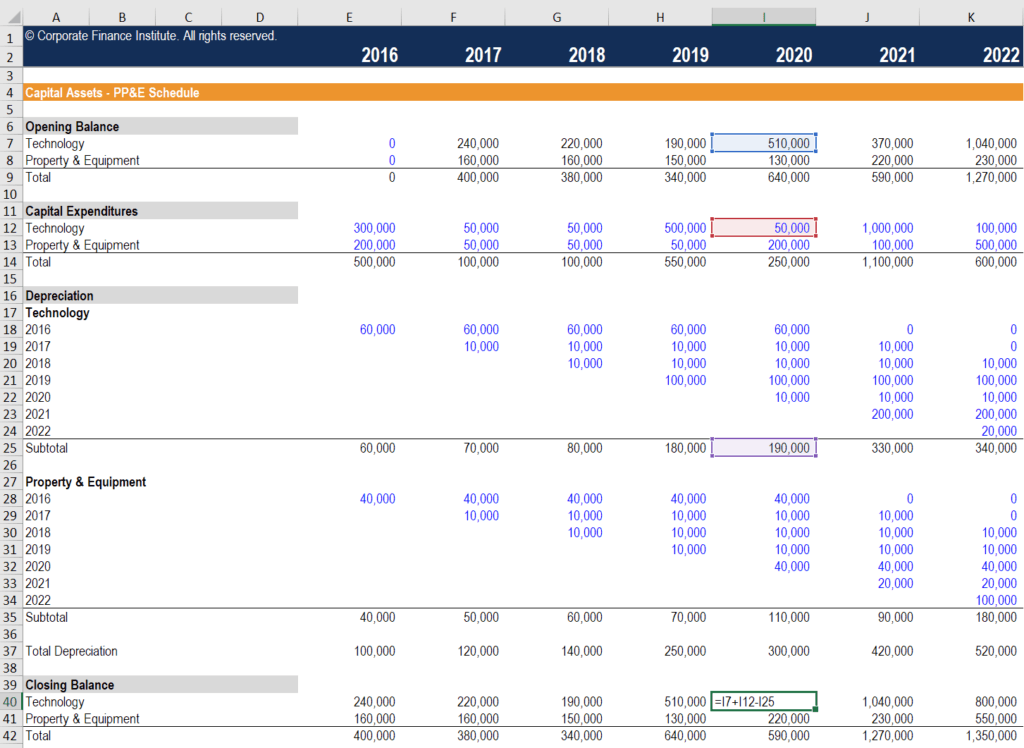

This property plant and equipment schedule template will help you keep track of pp&e balances and depreciation costs. The principal issues in accounting for property, plant and equipment are the recognition of the assets, The cost included shipment to port of gwadar. In this lesson, we go through a thorough example of how to do a property, plant and equipment note (ppe schedule) from beginning to end. The accumulated depreciation for the pp&e is calculated as follows:

Source: youtube.com

Source: youtube.com

B) biological assets related to. In this lesson, we go through a thorough example of how to do a property, plant and equipment note (ppe schedule) from beginning to end. Property, plant and equipment so that users of the financial statements can discern information about an entity’s investment in its property, plant and equipment and the changes in such investment. Property, plant and equipment may be requiring the replacement of some component parts during the useful life (such as the spare parts of a plant or walls of a building). The cost included shipment to port of gwadar.

Source: investopedia.com

Source: investopedia.com

In such circumstances, the entity will recognize the cost of replacement in the carrying value of relevant asset if it satisfies the recognition criteria given in this standard. Examples of pp&e include buildings, machinery, land. In this lesson, we go through a thorough example of how to do a property, plant and equipment note (ppe schedule) from beginning to end. The accumulated depreciation for the pp&e is calculated as follows: When compared to exxon�s total assets of over $354 billion for the.

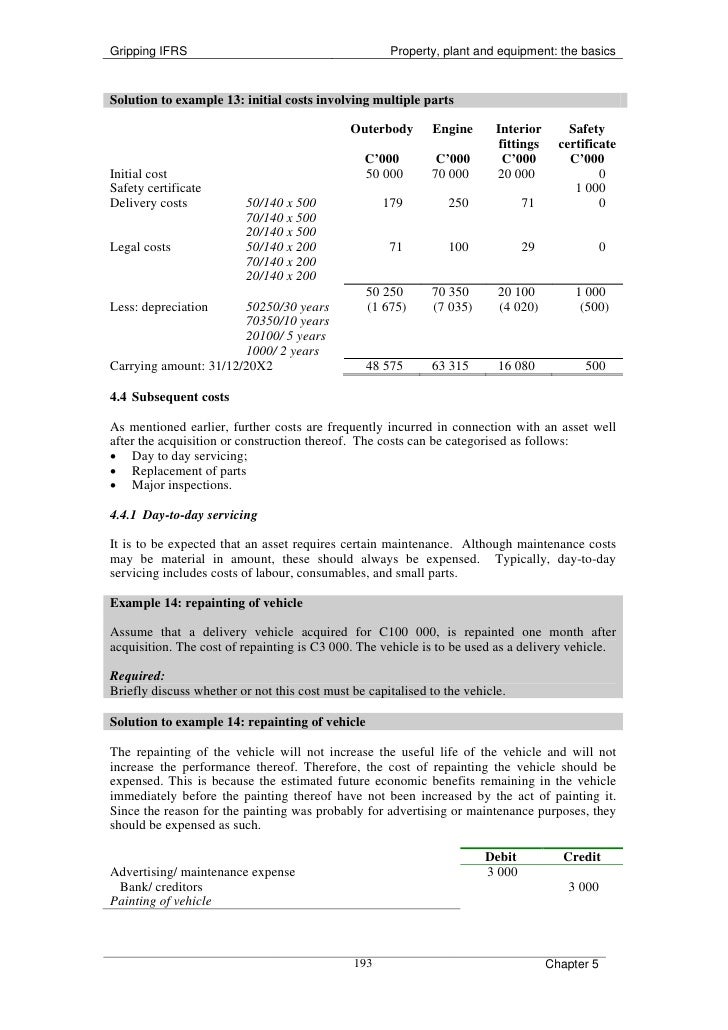

Source: slideshare.net

Source: slideshare.net

Ias 16 applies to all property, plant and equipment with the exception of: Property, plant and equipment are recorded at the acquisition. A) are held for use to produce/supply goods and services, for rental to others, or for administrative purposes; Freight for delivery of the plant components to the installation site amounted to $0.2 million. Ias 16 applies to the accounting for property, plant and equipment, except where another standard requires or permits differing accounting treatments, for example:

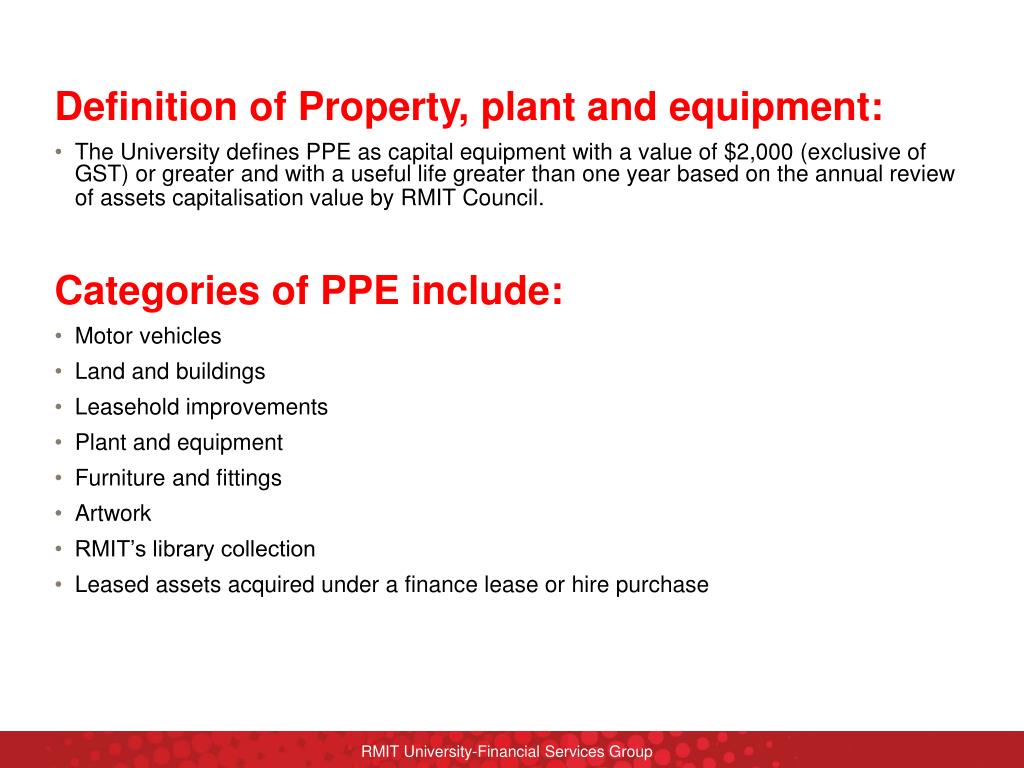

Source: slideserve.com

Source: slideserve.com

The existence and occurrence assertion means that the property, plant and equipment balance recognized in the financial statements actually exists at the reporting date. Property, plant and equipment amounts received from selling items produced while the company is preparing the asset for its intended use. Other standards have made minor consequential amendments to ias 16. A) are held for use to produce/supply goods and services, for rental to others, or for administrative purposes; Freight for delivery of the plant components to the installation site amounted to $0.2 million.

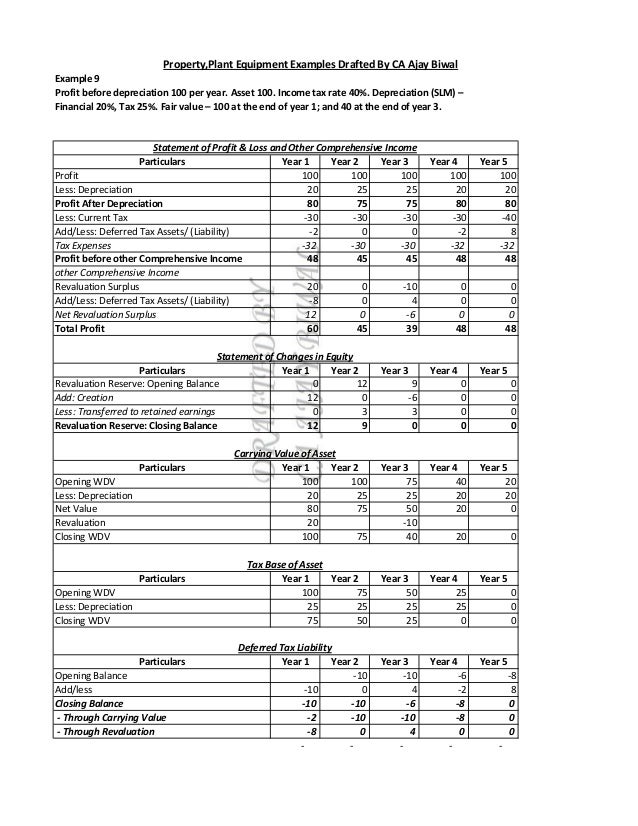

Source: slideshare.net

Source: slideshare.net

When compared to exxon�s total assets of over $354 billion for the. The principal issues in accounting for property, plant and equipment are the recognition of the assets, When compared to exxon�s total assets of over $354 billion for the. This property plant and equipment schedule template will help you keep track of pp&e balances and depreciation costs. The existence and occurrence assertion means that the property, plant and equipment balance recognized in the financial statements actually exists at the reporting date.

Source: staeti.blogspot.com

Source: staeti.blogspot.com

Ias 16 applies to the accounting for property, plant and equipment, except where another standard requires or permits differing accounting treatments, for example: Key assertions for property plant and equipment (ppe) audit. When compared to exxon�s total assets of over $354 billion for the. A) are held for use to produce/supply goods and services, for rental to others, or for administrative purposes; Other standards have made minor consequential amendments to ias 16.

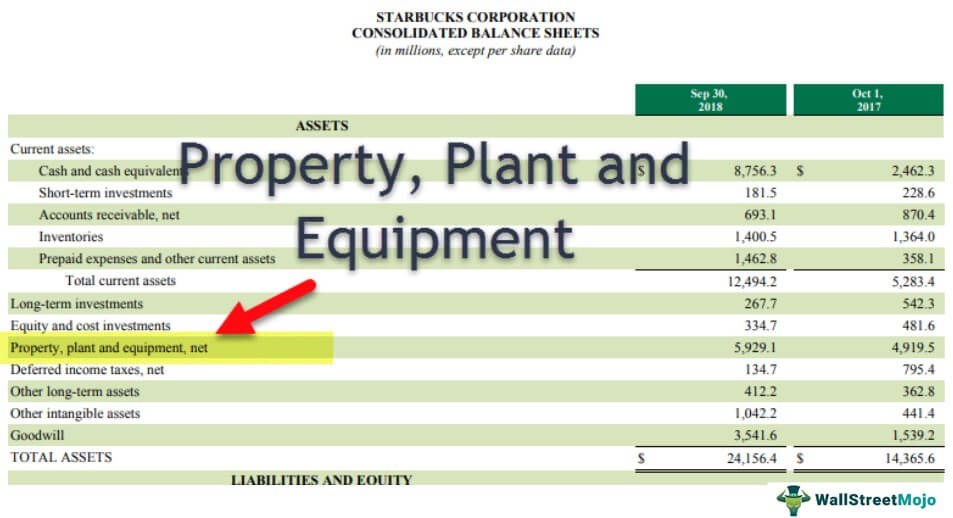

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Property, plant and equipment amounts received from selling items produced while the company is preparing the asset for its intended use. Labour expense (as per ias 19) resulting from the construction or acquisition of an asset, direct materials used, The accumulated depreciation for the pp&e is calculated as follows: Key assertions for the audit of property, plant, and equipment are described below: Paragraph ias 16.17 provides examples of directly attributable costs that can be included in the cost of pp&e.

Source: slideinshare.blogspot.com

Source: slideinshare.blogspot.com

$35,000,000 + $500,000 + $350,000 = $35,850,000. We can see that exxon recorded $249.153 billion in net property, plant, and equipment for the period ending september 30, 2018. Items grouped within a class are typically depreciated using a common depreciation calculation. Instead, a company will recognise such sales proceeds and related cost in profit or loss. Property, plant and equipment amounts received from selling items produced while the company is preparing the asset for its intended use.

Source: xbrlsite.com

Source: xbrlsite.com

Property, plant and equipment objective 1 the objective of this standard is to prescribe the accounting treatment for property, plant and equipment so that users of the financial statements can discern information about an entity’s investment in its property, plant and equipment and the changes in such investment. A property record unit may be composed of one or more retirement units. In accordance with ias 16® property, plant and equipment, all costs required to bring an asset to its present location and condition for its intended use should be capitalised. In the above example, ella may want to purchase enough land to allow for a building and a small dog park area. Property, plant and equipment may be requiring the replacement of some component parts during the useful life (such as the spare parts of a plant or walls of a building).

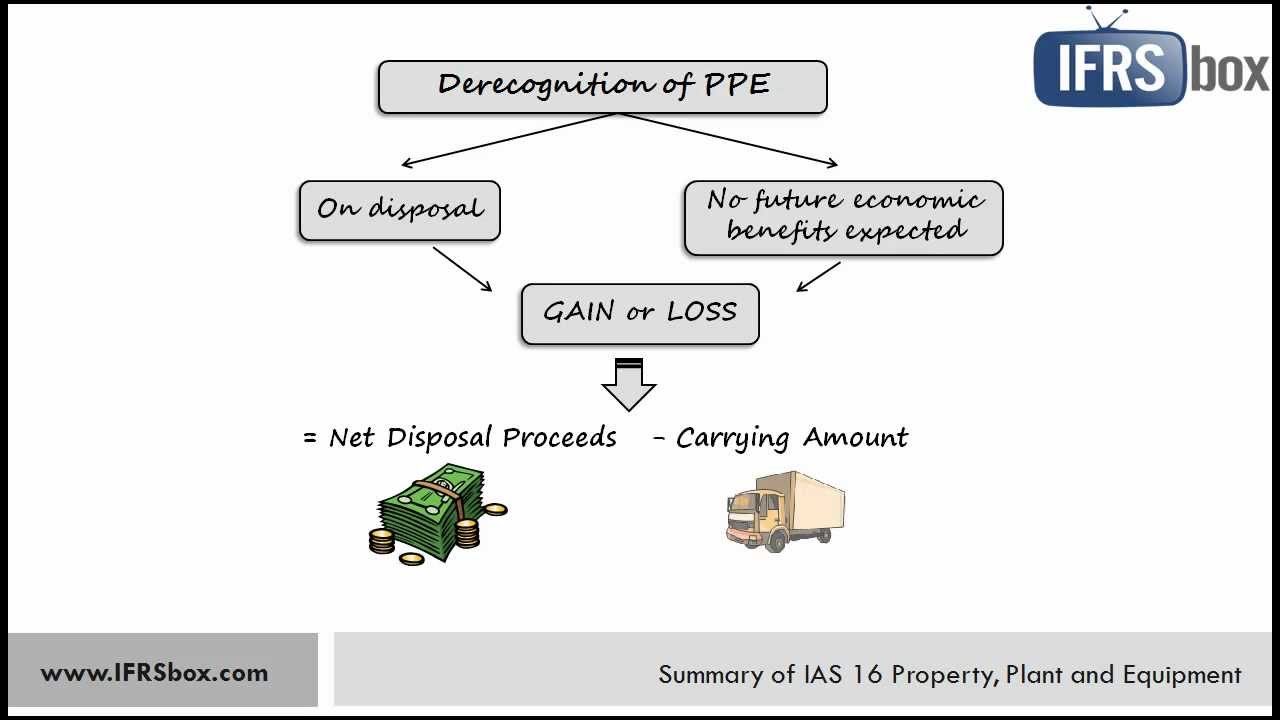

Source: youtube.com

Source: youtube.com

So if the entity acquires a property, plant and equipment item at the beginning of 20x1, and it’s residue value and useful life changes during 20x3, the following steps are to be taken to account for this change accurately: Labour expense (as per ias 19) resulting from the construction or acquisition of an asset, direct materials used, Property, plant and equipment so that users of the financial statements can discern information about an entity’s investment in its property, plant and equipment and the changes in such investment. Property, plant and equipment may be requiring the replacement of some component parts during the useful life (such as the spare parts of a plant or walls of a building). The accumulated depreciation for the pp&e is calculated as follows:

Source: principlesofaccounting.com

Source: principlesofaccounting.com

The selection of property record units determines the manner in which costs are assembled and recorded in the property records. The principal issues in accounting for property, plant and equipment are the recognition of the assets, Ias 16 applies to all property, plant and equipment with the exception of: This property plant and equipment schedule template will help you keep track of pp&e balances and depreciation costs. B) biological assets related to.

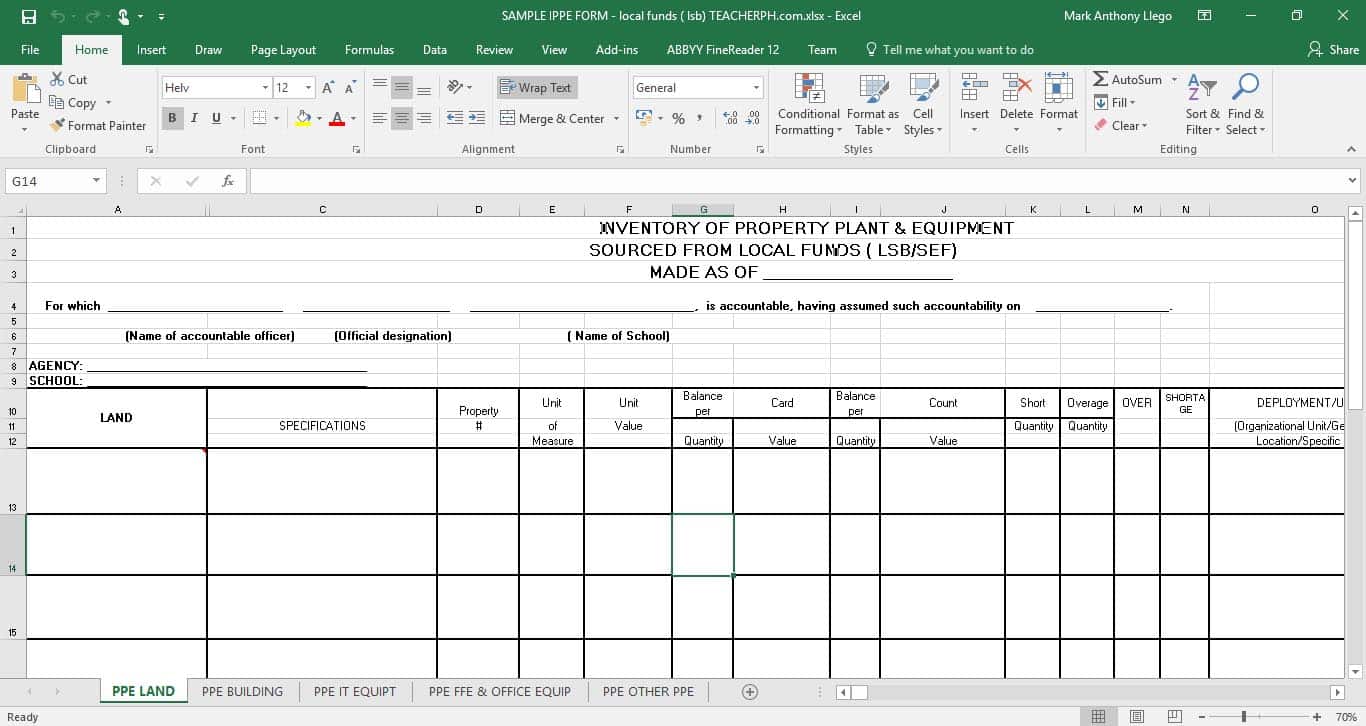

Source: teacherph.com

Source: teacherph.com

In this lesson, we go through a thorough example of how to do a property, plant and equipment note (ppe schedule) from beginning to end. Instead, a company will recognise such sales proceeds and related cost in profit or loss. The accumulated depreciation for the pp&e is calculated as follows: $28,850,000 / 12 years = $2,404,167. Land purchased for a business is an example of property.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Note that directly attributable costs do not need to be incremental. A property record unit may be composed of one or more retirement units. $28,850,000 / 12 years = $2,404,167. The accumulated depreciation for the pp&e is calculated as follows: Property, plant and equipment may be requiring the replacement of some component parts during the useful life (such as the spare parts of a plant or walls of a building).

Property, plant and equipment so that users of the financial statements can discern information about an entity’s investment in its property, plant and equipment and the changes in such investment. In accordance with ias 16® property, plant and equipment, all costs required to bring an asset to its present location and condition for its intended use should be capitalised. In such circumstances, the entity will recognize the cost of replacement in the carrying value of relevant asset if it satisfies the recognition criteria given in this standard. In the above example, ella may want to purchase enough land to allow for a building and a small dog park area. Paragraph ias 16.17 provides examples of directly attributable costs that can be included in the cost of pp&e.

Source: accountingcrashcourse.com

Source: accountingcrashcourse.com

Ias 16 applies to the accounting for property, plant and equipment, except where another standard requires or permits differing accounting treatments, for example: Peace corps | ms 711 accounting for property, plant, and equipment page 4 (o) leasehold improvements refers to any construction costs (e.g., alter, renovate, add, or remodel) incurred for a leased property (e.g., building an extension to an existing or new office or making an improvement for added security to an existing residence). B) biological assets related to. The cost included shipment to port of gwadar. The selection of property record units determines the manner in which costs are assembled and recorded in the property records.

$35,000,000 + $500,000 + $350,000 = $35,850,000. The cost included shipment to port of gwadar. Ias 16 definition property, plant and equipment (ppe) are tangible assets that: Property, plant and equipment may be requiring the replacement of some component parts during the useful life (such as the spare parts of a plant or walls of a building). Property, plant and equipment so that users of the financial statements can discern information about an entity’s investment in its property, plant and equipment and the changes in such investment.

Source: slideshare.net

Source: slideshare.net

Property, plant and equipment amounts received from selling items produced while the company is preparing the asset for its intended use. Ias 16 definition property, plant and equipment (ppe) are tangible assets that: This property plant and equipment schedule template will help you keep track of pp&e balances and depreciation costs. Freight for delivery of the plant components to the installation site amounted to $0.2 million. In selecting the property unit, consideration should be given to its.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title property plant and equipment examples by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.